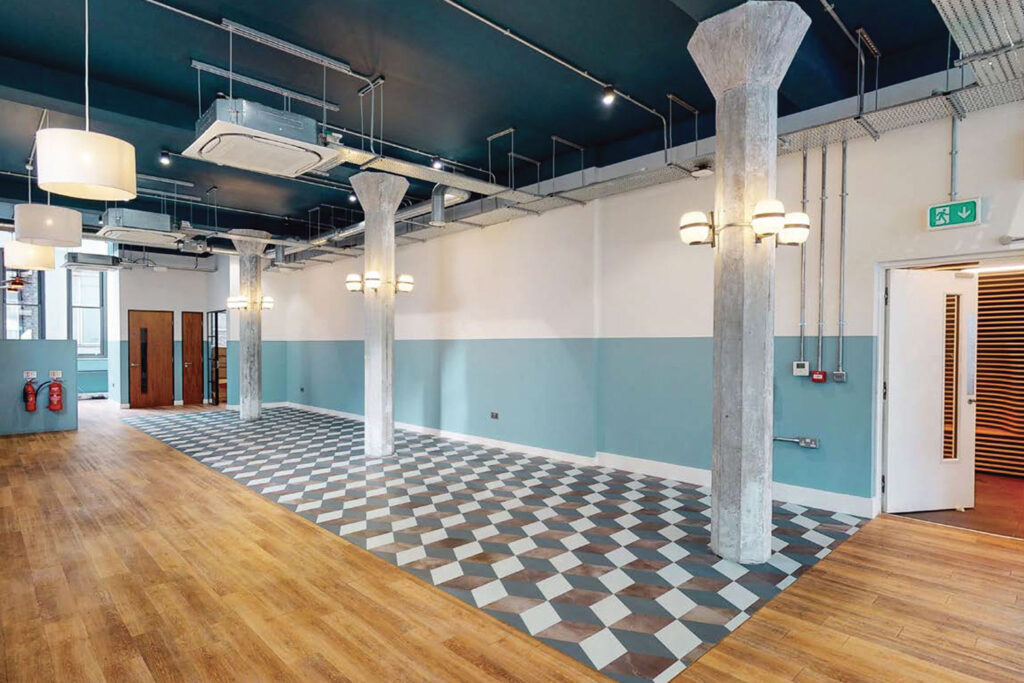

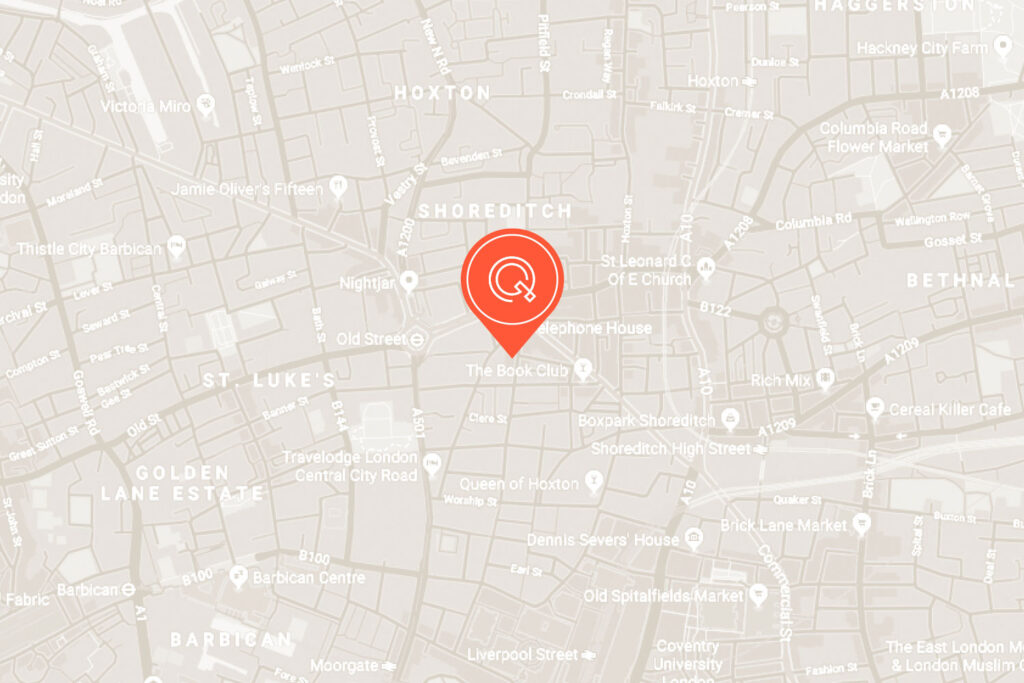

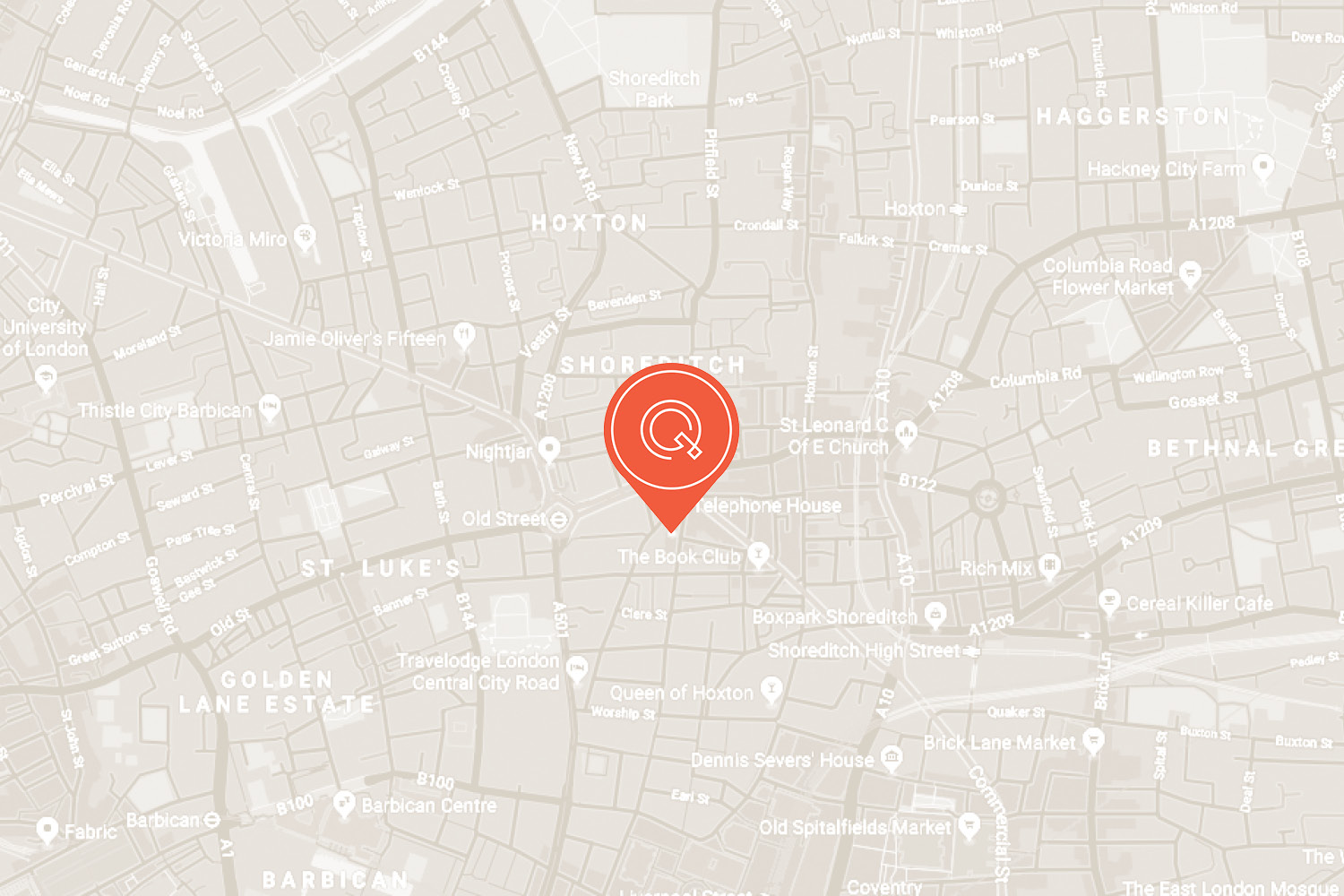

Brockton Everlast bought the vacant building that adjoins their existing holding of Telephone House to gain control over the wider investment. QuoinStone were appointed as asset managers to initiate and manage the refurbishment and leasing.

The property is now fully let to 6 high quality occupiers from the tech, finance and property sectors.